MS-4 Question Bank (12)

MS-4 Question Bank

MS-4 December, 2015

Written by sales@mbaonlinepapers.com sales@mbaonlinepapers.comMANAGEMENT PROGRAMME

Term-End Examination December, 2015

MS-4 : ACCOUNTING AND FINANCE FOR MANAGERS

Time : 3 hours Maximum Marks : 100

Note : (i) Attempt any five questions.

(ii) All questions carry equal marks.

(iii) Use of calculators is allowed.

1. (a) Explain the 'Accrual Concept' and the 'Consistency Concept' in accounting and signify their importance to an accountant.

(b) Distinguish between 'Operating Profit' and 'Net Profit'. Which is a measure of operational efficiency of a company ? Distinguish between Capital expenditure and Revenue expenditure. Which is taken

into account for determining the Operating Profit ?

2. What do you understand by Fund Flow Statement ? How does it differ from a Cash Flow Statement ? Explain the main items which are shown in the fund flow statement and the purpose of preparing this statement.

3. What do you understand by Discounted Cash Flow Techniques of Capital Budgeting ? Briefly

explain the Net Present Value Method and Internal Rate of Return Method of appraisal of

projects. Which of the two would you rank better and why ?

4. Distinguish between :

(a) Profitability Index and Profitability Ratios.

(b) Earnings Yield and Dividend Yield.

(c) Fixed Budget and Flexible Budget.

(d) Direct Labour Rate Variance and Direct Labour Efficiency Variance.

5. Explain the following statements, giving reasons :

(a) Debt is a double-edged weapon.

(b) Depreciation acts as a Tax Shield.

(c) Fixed Costs are variable per unit and Variable Costs are fixed per unit.

(d) When the use of operating and financial leverages is considerable, small changes insales will produce wide fluctuations in Return on Equity and E.P.S.

6. "Zero-based Budgeting provides a solution for overcoming the limitations of a traditional

budget". Explain this statement and describe the process of preparing a Zero-based Budget.

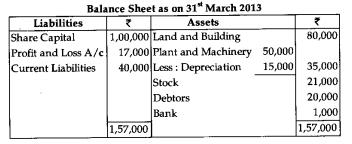

7. Following is the abridged Balance Sheet of ABC Company Ltd. as on 31st March 2013.

With the help of additional information given below, you are required to prepare Profit and Loss

Account and a Balance Sheet as on 31st March 2014.

(a) The Company went in for re-organisation of capital structure with the share capital

remaining the same but other liabilities were as follows :

Share Capital 50%

Reserves 15%

5% Debentures 10%

Trade Creditors 25%

Debentures were issued on 1st April, interest being paid annually on 31st March.

(b) Land and Buildings remain unchanged. Additional Plant and Machinery has been purchased and a further depreciation (f 5000) written off.

(The total fixed assets then constructed 60%of the total gross fixed and current assets.)

(c) Working Capital Ratio was 8 : 5.

(d) Quick Assets Ratio was 1 : 1

(e) Debtors (4/5th of quick assets) to sales ratio revealed a credit period of 2 months. There

were no cash sales.

(f) Return on Net Worth was 10%.

(g) Gross Profit was @ 15% of sales.

(h) Stock Turnover was eight times for the year ignore taxation.

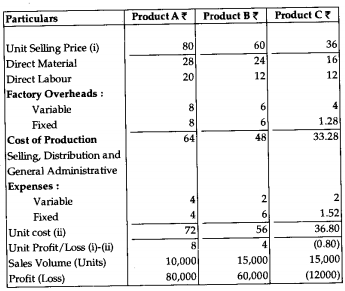

8. While finalising the plans for the Coming Year the excutives of XYZ Co. Ltd. thought that it will be advisable to have a look at the product-wise performance during the current year. The

following information is furnished :

MS 4 JUNE 2015

Written by sales@mbaonlinepapers.com sales@mbaonlinepapers.comMANAGEMENT PROGRAMME Term-End Examination June, 2015 MS-4 : ACCOUNTING AND FINANCE FOR MANAGERS

. 1. (a) What do you understand by Accounting Standards ? How do they differ from Accounting Concepts ? Why should the accounting practices be standardised ? Explain. (b) Explain the 'Money Measurement Concept' and the 'Accrual Concept'. What are the limitations of the former concept ? Explain.

2. (a) What are intangible assets of a firm ? Why are they shown in the Balance Sheet ? What is meant by amortisation of such assets ? Give reasons for the same.

(b) What do you understand by Appropriation of profits of a company ? How are the profits appropriated ? What will be the effect on appropriation of profit of a company if :

MS-4 1 P.T.O.

the company has issued debt instead of equity shares to finance its activities, and the accountant has treated a revenue expenditure as capital expenditure.

3. What do you understand by cost of capital ? What is its significance in financial decision making ?

Explain how is the weighted average cost of capital computed ?

4. Distinguish between :

(a) Contingent liabilities and accrued liabilities.

(b) Funds from Operations and Net Profit

(c) Straight line Method and Written down Value Method of charging depreciation

(d) Direct Material Price Variance and Direct Material usage Variance

5. (a) "Other things remaining the same, firm with relatively stable sales are able to incur relatively high debt ratio". Do you agree with this statement ? Give reasons for your

answer.

(b) Explain fixed budget, flexible budget and rolling budget. Point out the differences

between them and explain their utility for a firm.

MS-4 june-2007

Written by sales@mbaonlinepapers.com sales@mbaonlinepapers.comMS-4 - june-2007

MS-4 : ACCOUNTING AND FINANCE FOR MANAGERS

1. (a) Explain the Continuity concept and the Periodicity concept and discuss their significance.

(b) Explain the nature of accounting function and describe the role played by the Accountant in a business organisation.

2. The following items appear on the Trial Balance prepared from the books of Mr. Kamal Saxena as on 31st March 2006 after making necessary adjustments for depreciation on fixed assets, outstanding and accrued items and placing the difference under Suspense Account.

Machinery: 1,70,000

Furniture: 49,500

Sundry Debtors: 38,000

Drawings: 28,000

Travelling Expenses: 6,500

Insurance: 1,500

Audit Fees: 1,000

Salaries: 49,000

Rent: 5,000

Cash in hand: 7,800

Cash at Bank: 18,500

Stock in trade (1-4-2005): 80,000

Prepaid Insurance: 250

Miscellaneous expenses: 21,200

Suspense A/c (Dr.): 39,400

Sundry Creditors: 82,000

Capital Account: 2,45,750

Outstanding Expenses :

Salaries: 1,500

Printing: 600

Audit Fees: 1,000

Bank Interest (Cr.): 1,200

Discounts (Cr.): 1,800

Sales less Refurns): 6,80,00

Discount allowed: 1,200

Printing and Stationery: 1,500

Purchases (less Returns): 4,60,00

Depreciation :

Machinery: 30,000

Furniture: 5,500

On a subsequent scrutiny the following mistakes were noticed

(i) A new machinery was purchased for Rs. 50,000 but the amount was wrongly posted to Furniture Account as Rs. 5,000.

(ii) Cash received from Debtors Rs. 5,600 was omitted to be posted in the ledger.

(iii) Goods worth Rs. s,000 withdrawn by the proprietor for personal use, but no entry was passed.

You are further told that :

(a) Closing Stock amounted to Rs. 47,500.

(b) Depreciation on Machinery and Furniture has been provided @ 15% and 10% respectively On declining balance system. Full year's depreciation is provided on addition.

You are required to prepare a Trading and Profit and Loss Account for the year ended on 31st March 2006 and a Balance Sheet as on that date.

3. (a) Explain the concept of cost of capital as a device for establishing a cut-off point for capital investment proposals.

(b) Discuss the limiting factors in the reliability of capital budgeting techniques including the discounted cash flow techniques.

4. (a) What is optimum cash balance ? How can it be determined ? Explain.

(b) Distinguish between Cash Flow Statement and Funds Flow Statement." What purposes do they serve? How do you calculate Funds from Business Operations while preparing a Funds Flow Statement? Explain.

5. (a) Explain the three important control ratios that are used to compare the actual performance with the budgeted performance.

(b) Distinguish between Fixed Budget and Flexible Budget. When is a Flexible Budget considered desirable ? Explain.

6. A company produces a single product which is sold by it presently in the domestic market at Rs. 75 per unit. The present production and sales is 40,000 units per month representing 50% of the available capacity. The cost data of the product are as under:

Variable cost per unit Rs. 50.

Fixed cost per month Rs. 10 lakh.

To improve profitability, the management has 3 proposals on hand as under :

(a) To accept an export supply order For 30,000 units per Month at a reduced price of Rs. 60 per unit, incurring additional variable costs of Rs. 5 per unit towards export packing, duties etc.

(b) To increase the domestic market sales by selling to a domestic chain store 30,000 units at Rs. 55 per unit, retaining the existing sales at the existing price.

(c) To reduce the selling price for the increased domestic sales as advised by the sales department as under :

|

Reduce Selling price |

Increase in Sales |

|

5 |

10,000 |

|

8 |

30,000 |

|

11 |

35,000 |

Prepare a table to present the results of the above proposals and give your comments and advice on the proposals.

7. Comment on the following statements :

(a) Operating cycle plays a decisive role in influencing the working capital needs.

(b) "Debt is a double-edged knife."

(c) Break -even analysis is not without limitations.

(d) Higher profit margin need not necessarily lead to higher rate of return on investment.

(e) A company's profitability is better judged by PBIT rather than by PAT.

8. Write short notes on the following :

(a) Absorption Costing

(b) Zero based Budgeting

(c) Direct Labour Variances

(d) Sunk Costs and Imputed Costs